How To Build Wealth In Your 50s – The Ultimate Money Guide

If you’re looking to learn exactly how to build wealth in your 50s without a bunch of hype and false promises, then keep reading on.

While you may not have as much time on your side if you are 50 or older, however, you can still learn how to become rich after 50 in a way that helps you live a free lifestyle, even while you’re aging.

What you’re going to learn is the real strategies to build wealth and passive income that older people use to get ahead of their younger counterparts.

No, you’re not going to be introduced to any “get rich quick schemes” of any kind here.

Because you may know it, or not… The average “millionaire” statistics and case studies have shown a few important facts about scaling any financial metric.

- The average millionaire is 62 years old.

- 80% of wealth is earned and not inherited.

- 61% of US millionaires are between 60 and 79 years old.

This means that even while you may be asking yourself, “Seriously, how can I build wealth in my 50s without wasting any more precious time?” You still have a great chance and opportunity to grow your wealth in meaningful ways.

We will show you financial strategies that will shine light on how to get ahead of the wealth creation curve, even though you may feel behind.

If you’re looking to add an immediate income stream to your portfolio, then sign-up to our FREE newsletter by clicking here. We will reach out to you right away with an opportunity we use to increase our income every single day….

Start building more wealth now.

Is It Too Late To Accumulate Wealth In Your 50s?

The short answer, is NO!

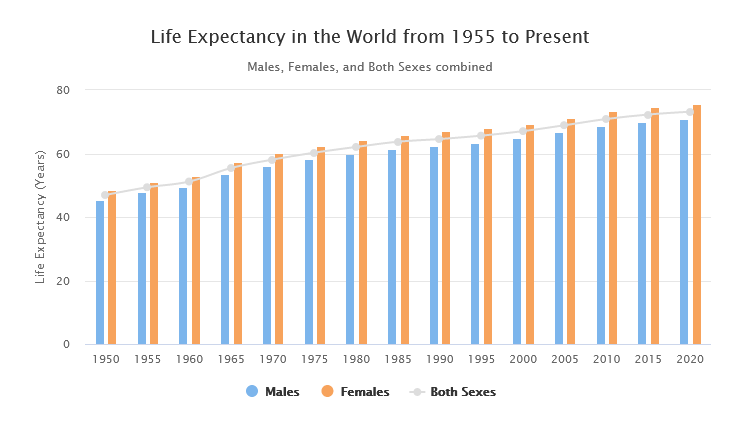

Even if you may be in your 60’s or older, the average lifespan of most people across the world is increasing drastically.

Image provided by: worldometers.info

This fact is allowing you much more in time to take the necessary steps needed to increase financial status and network, no matter what age you get started.

We often underestimate our ability to create money, and there are many reasons for this.

One of them, is that most people believe it’s difficult to start building wealth.

When in reality, the financial scaling process is really just a systematic way of earning passive income and saving more than you spend.

Learning to invest in things first that bring you more money, instead of spending money on material goods that you really do not need. (Such as maxing out credit cards for goods that have no use)

To build wealth online or offline it takes:

- Time

- Energy

- Money

- Effort

As we age, we do lose some of the compounding effect more time provides us, however, you still keep the 3 other fundamentals of wealth building in check.

And when you keep in mind we are living longer than ever before..

We can show YOU how to capitalize on the fundamentals of building wealth, regardless of age, that anyone can apply to build passive income sources. Without getting into massive debt.

What Are The Best Ways To Build Wealth In Your 50s?

The fundamentals of building wealth are the same regardless of your age!

In fact just compare the situations, if you take a look at some of the most successful figure heads in history, you’ll find that many of the wealthiest people never built their money successfully until they were at least 50, 60, or even 70.

To get started, we have put together 6 great methods to build wealth in your 20’s, 30’s, 40’s, 50’s – and even older!

- Cut Frivolous Spending

- Increase Your Income

- Invest In The Right Wealth Producing Assets

- Spend Your Money In The Right Places

- Invest In Your Company 401K Or A Self Funded IRA

- Pay Off Your Debts

These fundamentals apply to build wealth, regardless of age, sex, gender, or your preferred favorite kind of dessert!

You want to make sure you steer clear of anyone who suggests you’ll get rich quick, or without investing any money.

Often scammers tell you that you can “make money without doing anything”, but this is a clear lie.

The genuine and legit ways to make more income at 50 or older, are solid and have existed for thousands of years.

OK, lets walk you through these 6 genuine ways to accumulate solid money in your 50’s!

6 Best Ways To Build Wealth In Your 50s

To get the most out of reading this article, you’ll want to immediately use and apply the knowledge you’re about to go through.

Because when you’re trying to make a serious effort to learn more about how to accumulate wealth in your 50s, you have to take the action to match.

These following fundamentals for growing your money and net worth are for those people who are willing to take action.

Being able to manage your money successfully is inherently dependent on following these fundamentals of wealth very closely.

Even if you aren’t confident in yourself, anyone can learn with these strategies on how to create long lasting income at 50 and beyond.

1. Cut Frivolous Spending

“Oh no, we’re cutting costs… This means we’re shrinking!” – Nope! That’s not quite it…!

What you’re aiming to do when you want to scale and build wealth, is simply cut unnecessary costs in order to use that money to create more income streams.

The average person usually goes about it the wrong way, they spend money on material things first, and then do not have any money left over to better their personal finances and produce passive income.

Essentially they fail to spend their money in the right places.

Yes, you can spend your money on all the wrong things. But when you do this over time, you drastically decrease the amount of liquid assets and invested money available to you.

Of course you always want to have your basic living expenses covered, but then you should always look at every purchase you make in a different light.

You want to cut your cost and reduce your debt while investing that money into assets that pay you, or that make you more money in the long term, such as a good business or investment vehicle.

As an example: Do you purchase a new big screen TV, or do you invest that money in your local power companies drip plan?

It may not seem like a huge amount of money, but every dollar counts when you want to accumulate wealth fast.

Which purchase is going to bring you closer to being wealthy? If you want to build your wealth, you have to start looking at things much differently.

Ultimately it will come down to what’s more import to you. Do you want a new big screen TV, or do you want to create wealth?

8 Rules for Saving Money: Financial Tips That Might Save You One Day

We wanted to share some actionable tips on some steps you can take to CUT COSTS TODAY! (You should view each cost cut, as an investment and growth of your wealth. Because it is!)

- Cut down on unnecessary living expenses. You often waste money on buying food you’ll never eat, buying small gadgets, and making small unnecessary purchases that over time could instead equate to tens – hundreds of thousands of dollars invested or saved. Which will eventually equal a lot more net worth!

- Reduce how much you spend going out to eat. Yes, of course you can still go out to favorite restaurants. But, if you simply reduce how much you go out to eat, you can save thousands to tens of thousands of dollars every year. Think… If you’re 50, and over the next 10 years you save and invest $50,000 that would have been spent on food and unnecessary purchases , how much more closer you will be to reaching your wealth goals by age 60? (with the right investments and compound interest on your $50,000, it will add up to a whole lot more money!)

- Stop constantly upgrading your phone or vehicle to the “new and improved model”. No, you don’t need the iPhone 52, if you already have the iPhone 50. The differences between the “newer and next best thing” is often so small that you will never even notice. This is why you need to ignore the marketing done by these companies that attempt to give you a fear of missing out. You’re not missing out on anything, especially when your current vehicle does everything you need it to already. You need to make improvements in your investments for growing your wealth in your 50s, not letting cash waste away.

- Reduce consumption, you don’t need or even really want the majority of what you spend cash on. The mindset change for being a consumer to becoming a producer is HUGE. By being a producer, you enable yourself to drastically increase your cash supply by leaps and bounds. No longer are you at the whim of the advertisements you see around you… You now are in charge and in control of the direction it flows.

How to Stop Impulse Buying: 16 Ways to Quit Mindless Shopping and Spending

If you seriously want to learn how to accumulate cash in 50s or at any age – these are some of the best cash building practices you can follow to cut your cost, reduce your debt and increase investment in assets and activities that make more income.

Did you know that we have created a strategy that will help you build an additional income stream in our FREE newsletter?

You can sign up here to start your journey to building wealth in your 50’s.

2. Increase Your Income

It sounds difficult to increase your income, however in most cases the strategy to do so is pretty simple.

The following building wealth learning strategies for increasing your income are going to apply to you whether you own a business or have a job.

You should use these methods for growing your income and net worth seriously, as they are extremely effective at helping you increase your total income every year, which is the best.

How To Increase Your Business Income

There are a variety of efficient ways that any business owner can increase their income quickly and without raising costs.

10 Best ways to cut expenses and increase your business income:

1) Go through your books with a fine tooth comb and reduce unnecessary expenses.

2) Cut down on company-sponsored events and dinners.

3) Hire a more efficient IT department or outsource IT services.

4) Hire a more efficient marketing team or outsource marketing services.

5) Invest in new equipment to make your company more efficient.

6) Consider buying office space in a less expensive location.

7) Increase your customer base by marketing your business online.

If your business is not online, you are leaving lots of money on the table, in both local or national exposure.

8) If your business is online start split testing your sales pages.

By running split tests, you’re able to increase the effectiveness of your business and thus both reduce expenses and increase income & profits.

For example, if you have an conversion rate of 3%, and you are able to run split tests that increase your rate to 6%, you can immediately double your income from the same effort.

9) Up-sell your customers by adding additional products and services that bring in bigger profits. (High Ticket Sales)

This can be a total game changer.

10) Build better relationships with your current customers and I guarantee your profits will go up.

And if you do not have a business, consider starting a side hustle online immediately. The digital world is booming, and their are people killing it online working from home.

How To Increase Your Income From Your Job

There are 3 main ways to increase income from your job, or to increase the total amount of income you bring in. Both of these methods increase your total wage / salary, and are extremely effective.

- Ask for a higher wage / salary. The majority of the time people ask for raises, they get one. If you have been at a job for a lengthy amount of time, come in on time, perform your duties well, and are respectful – there is no reason why your boss shouldn’t award you a raise. Especially when you’re older with much more experience then your younger counter parts. Getting a raise is great for bringing into reality, “how to create lasting streams of income”

- Work more or work overtime. Yes, this takes more of your time away from other parts of your life…. But, if you want to increase your income drastically, working 10-20% more overtime can mean a nice increase in total income, which you can use to build more wealth.

- If your job has no over-time available consider a second job as a temporary way to increase your job income, or better yet, it is very simple to start a business online, and you can do it working from the comfort of your home.

17 Home Businesses You Can Start For $50 Or Less

3. Invest In The Right Wealth Producing Assets

Investing in wealth growing assets is the #1 way to increase cash flow over time.

Your net worth, income, wealth, and much more will increase if you’re able to follow an investment strategy.

Even when you’re in your 50s, building your wealth through investments still is a very viable option.

In fact, investing is still among the best ways to grow any financial situation because of the amount of interest and ROI you can generate over the rest of a lifetime.

You’ll want to choose few main investments opportunities to put the majority of extra cash into.

Here are some of the best producing wealth building investments you can make right now.

Invest In Drip Stocks That Pay Good Dividends

Drip meaning – Dividend Reinvestment Program. A dividend reinvestment program (Buying DRIP Stocks) is a method of investing in stocks that allows investors to reinvest their dividends into additional shares of their chosen stock.

DRIPs are a very popular investment option due to their low cost, the potential for compounding returns, and the ability to build up a portfolio over time with minimal effort.

With a DRIP, investors can buy fractional shares and even use automatic investments to grow their holdings in some cases without having to pay any fees.

Your not going to build wealth overnight with DRIPS, but with the right investment planning, you can build your self a very nice nest egg, and income streams that pay you like clockwork.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – without brokerage fees.

Dividend Aristocrats are the perfect form of DRIP stocks. Dividend Aristocrats are elite companies that satisfy the following:

- Are in the S&P 500 Index

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

They are an excellent vehicle for building wealth and a steady stream of passive cash flow, and the best part for many investors who do not have large sums of money to put into stocks upfront, is you can grow these investments over time.

This makes a powerful (and very cost-effective) compounding machine.

I learned about DRIPS many years ago, and have invested into many DRIP stocks including my local power company DRIP plan ever since.

Utility providing companies in many cases can be a great place to start and investigate their dividend history.

I got the idea from a little book by Deborah Rosen Barker & Julie Behr Zimmerman “Julie and Debbie’s Guide to Getting Rich on Just $10 a Week.”

It is an older book, but if you want to learn how to do simple investing including DRIPS, I highly recommend it. The book is in layman’s terms, an absolute easy read.

Now the older you are when you get started investing, the more you need to stock away each month, so you get the exponential growth factor a lot faster.

Here is another really great resource for finding the best Dividend Aristocrats stocks list.

Invest In Cryptocurrency

Cryptocurrency has quickly became one of the fastest wealth building assets in the entire world’s history.

Cryptocurrency and the blockchain are simply put, the next revolution to how we handle, transfer, pay, invest, and use money.

You can take a look back at all of the revolutions that have happened throughout our history, and this one will be the largest and most impactful yet for building generational wealth that lasts.

You have the Industrial Revolution, wars, the creation of the internet, and many other global changes that have changed the world forever.

This digital change, is the one that is going to set the world to completely change how finances is managed yet again.

It is not difficult to get started with Crypto, and start building a portfolio, and in our opinion it would be very smart to do so.

We are not an investment advisor, nor are we offering you investment advice, we make no claims or guarantees that you will make any money with cryptocurrencies or any investment. Only that the opportunities exist, and they will be here in the future. We think cryptocurrencies are the future, however, we are not fortune tellers. Do your own due diligence.

And Never invest money you can not afford to lose. You should grow investments overtime with money that is allocated for this purpose. NEVER make investments based on hype!

20 Smart Financial Habits To Build Wealth At Any Age

Benefits of investing in Cryptocurrencies:

1) Easy and simple to get started

2) No buy requirements – You can invest very small amounts at a time

3) You can buy fractions of most digital currencies

3) Instant transactions for both buying and selling

4) Some digital currencies pay rewards/interest much higher than traditional banking

Crypto currencies are challenging the status quo and changing the way we view money. Just understand Crypto can be very volatile.

Even if someone is in their 50’s or older, Cryptocurrency we believe should be on your list for investments to make and manage, or to at least diversify with.

You can go here now to create a free CoinBase account and begin trading cryptocurrency now.

They also have a learning library so you can learn more about Crypto & free rewards.

Real Estate Investments

Real Estate is one of the most profitable multi-generational wealth builders that the older generations have used to build massive amounts of lasting wealth for thousands of years now.

Real estate is tried, tested, and proven to create extreme wealth. In fact, the average millionaire has at least 3 – 4 real estate assets underneath their control at any given time.

Unlike stocks or Crypto, real estate that you own is tangible – it’s physical.

Real estate has historically served as an effective inflation hedge and has multiple ways you can invest and profit from it.

- Buy REITs (real estate investment trusts) – A REIT, or real estate investment trust, is a company that owns, operates or finances real estate. Investing in a REIT is an easy way for you to add real estate to your portfolio, providing diversification and access to historically high REIT dividend payments. Fundrise is a popular online company, that allows you to get started for as little as $10.

- Use an online real estate investing platform – Real estate investment platforms connect real estate developers to investors who want to finance projects, either through debt or equity. The investment is made via online real estate platforms, which are also known as real estate crowdfunding. This still requires investing capital, although less than what’s required to purchase properties outright.

- Flipping investment properties – Flipping houses allows investors to purchase outdated properties at a lower price, renovate them and then sell them for a profit.

- Wholesaling and buying a turnkey rental property – Many people usually start out with just one property, but after the first couple of years, they are able to buy more properties with a mix of their rental and W2 income. Do this several times and you will build up nice rental income portfolio.

- Renting out property you already own – Whether this be a room, a vacant lot, garage storage or your home.

These are several of the most popular ways investors can benefit from real estate.

The important benefits of investing in real estate are increase in property value due to appreciation as well as good passive cash flow in the form of rental income.

Since the 2008 recession, real estate has become one of the most attractive investments for people looking to make a return.

Following the 2008 recession, many people lost their jobs and resorted to trading in their stocks for real estate investing as a way to make an income.

As time has progressed, it has been determined that becoming a landlord is more beneficial than ever in today’s market.

Investing in real estate can be an effective way to grow one’s finances. The risk is lower than most other investments because, unlike the stock market, the supply of houses or apartments does not change based on investment trends or because Elon Musk tweets about it.

There are many benefits of investing in real estate including:

1) Lower risk

2) Tax advantages

3) Appreciation potential and long-term returns

4) Increased passive Cash Flow

People will always need a place to live, and they’ll pay a premium to live near amenities and employment.

This means your apartment building or single family home is worth more because it is close to schools, parks, employers or a college. And you’ll receive rental income as long as people want to live there.

This is why in the “real estate versus stocks” debate, real estate wins when you want cash flow and security.

If you don’t have the cash to buy investment property outright, financial institutions will loan you money to do so. They will rarely offer loans so you can buy stock, equity in a business or even business equipment.

This is because real estate is an actual real asset, and their loan is secured by a physical building that has high, intrinsic value.

For many, the ability to leverage other people’s money is why real estate wins in the real estate versus stocks investment argument.

The returns on real estate investment are quite predictable. You know what property values are and rental rates. While it takes more time and research, this type of investment can help build long lasting wealth.

If you want to learn more about real estate investing, here is a great resource you can use and learn from.

You’re going to learn that with real estate you get to know how to grow finances in the most secure way possible. (And real estate helps you build wealth at any age really)

Invest In Yourself & Your Skill-set

The #1 asset used in every aspect of life that you should invest in, is yourself.

Your mindset, your income, your health, and much more are all either grown or degraded by how well you understand and apply knowledge.

This is why the greatest regret from most people who are older, is their lack of investing in more of the things in life that mean the most to them. Family, friends, their career, health, etc.

Investing in yourself is important for success in life. Our self-worth, our confidence, and our happiness are all influenced by how we invest ourselves in the world.

Investing in yourself means investing in your mind, body, and spirit as well.

It means that you take time to recharge your batteries after a hard day. It means that you stop thinking about what’s wrong with you and start focusing on what’s right with you.

It means you learn time management so you can spend quality time with your friends and family.

25 Essential Life Lessons Everyone Should Learn and Adopt for a Fulfilled Life

Benefits of investing in yourself:

1) Better health

2) More personal satisfaction

3) Quality of life

4) Closer relationships

5) Positive outlook

6) Less Stress

If you want to learn more about how to increase your financial situation by investing in yourself, here’s a great resource for that as well. https://jonweberg.com/finallywealthy/

In my mind, this is by far the best way to improve any financial situation. (some of the best financial planning is first investing in you)

4. Spend Your Money In The Right Places

It’s seems contradictory right? The reality is, spending money in the right places is your key to knowing exactly how to make money when you’re over 50, and again at any age.

You of course can save and invest money in order to grow your finances as I’ve already mentioned.

But, the places / assets / items you spend money on can also dictate your growth of wealth over time too.

Think about the big lifetime purchases you will make or have already made in life such as

- Houses

- Other Property

- Jewelry

- Vehicles

- Recreational vehicles

- Education

- Life Insurance

- Business

- Hobbies

- Furniture

- Vacations

When you make investments or purchases in any of these 11 areas, you are doing 1 of 2 things:

- Investing in an asset that increase in worth and thus increases your wealth.

- Investing in an asset that decreases in worth and thus decreases your wealth.

This is why it is so important that when you make big purchases of any kind, that you ensure you make wealth building purchases in appreciating assets that will improve your finances for the better. (A great comprehensive financial planning strategy)

Spending more money in the right way like I’ve described, will help you know how to earn passive income after 50 that keeps growing in value for decades to still come.

If you are serious about increasing your wealth by:

- Cutting costs – Saving Money

- Investments (Stock, Real estate and cryptocurrencies)

- Grow your income

- Investing in YOU

- Spending more to make more

Then why not check out this amazing home based business where we will show you how to earn more income online?

Saving More Will Improve Your Wealth

Saving your money in a bank, will it create wealth?

Not really, because to be blunt, banks pay absolutely terrible interest rates, your money is not going to multiply very fast.

But it will create security and aide you in major life expenses, hard times or catastrophes that may happen in life, like the loss of a job, you need a new roof, or unforeseen long term illness, etc.

This is why it is important to put money away for a rainy day, and lot’s of it. You should save up at least a bare minimum of 8 to 12 months of living expenses, do this over time, say put away 20% of your take home pay in the bank.

So if you take home $3000 monthly after taxes, you would want to put away at least $600 monthly into the bank.

Long term this will always create security and a cushion for you. You will love watching your bank account grow each month.

5. Invest In Your Company 401K Or A Self Funded IRA

Now, another way of saving more of your money towards building wealth, is through your jobs 401K, an IRA or other similar retirement account you put into, and sometimes the company you work for matches it in some way.

You should consider investing 15% of your income in your retirement account.

Your employer match, if you have one, counts as well. If you save 5% of your income and your company matches another 5%, you’ve accomplished a 10% savings rate.

Now increase your contribution another 5% and you have met your 15%.

This money over time will grow and build a nice nest egg for you no matter what age you are, why it is so important to take your companies retirement plan seriously.

A company match is like getting free money, make sure and take advantage of it.

My father unfortunately did not take advantage of his companies 401K until he was almost 50, but even though he did not, he still had over $100,000.00 in his account when he retired at 62.

The longer you wait the less you will have, so do it now.

Getting Rich Isn’t About Luck: You Just Do It

Health Savings Account Through Life Insurance

There are certain life insurance policies that operate like investments accounts. You should ask a financial advisor how you can create one of these life insurance and health savings account soon.

This will ensure you are able to have a successful life insurance policy that can also be used & leveraged before death.

Open An IRA Account

As always, having retirement savings account is also a good method for investing money and growing your over all wealth. So if you do not have a 401K account through a job, and or are self employed, you should really open up an IRA.

An individual retirement account (IRA) is a long-term savings account that individuals with earned income can use to save for the future and enjoy certain tax advantages.

The IRA is designed primarily for self-employed people who do not have access to workplace retirement accounts such as a 401(k), which is available only through employers.

You can open an IRA through a bank, an investment company, an online brokerage, or a personal broker.

6. Pay Off Your Debts

According to CNBC the average American has $90,460.00 of debt.

In our opinion, if you have that large of debt, the only time you should see the inside of a restaurant is if you own it or you’re working there…

The fact is, more than half of Americans actually spend much MORE than they earn each month, according to a Pew Research study, and use credit to bridge the gap.

This is not surprising as we live in a world where everyone wants instant gratification, and many people believe the only way they will get wealthy is by winning the lottery.

When you have more money going out, than you have coming in, that is a big problem and it needs to be fixed immediately, otherwise you will never build wealth.

Ways to pay off debt so you can start growing your financial status.

1) You will need to become accountable and committed, otherwise building wealth by paying off debts will not work.

2) Write down your expenses and debt, all of it.

3) Stop eating out!!

4) Cut all frivolous spending, do not buy anything you do not absolutely need. Stop buying anything at gas stations except gas.

Some people spend so frivolously they could actually build wealth by just investing this money instead of buying junk.

5) Have a garage sale, or list your stuff on Facebook local buy and sell pages (social media is such a great way to make extra money) You will be surprised what people will buy on there.

Literally clear the clutter and sell everything you can live with out. Everything!

6) Work over time, or a second job, or create a side hustle online.

7) Create a bare essentials budget/only to meet the most essential needs. Live by it, it is temporary. Do not buy anything on credit.

8) Start with the smallest debt balances first, and pay them off with all extra income you are creating from these steps.

9) Each time you pay one balance off, you will have more money each month to pay on the next, and so on. This will create a snowball effect, and eventually you will pay off your debt extremely fast.

10) Once you have paid off all of your debt, start putting all that extra money into savings and investments that grow your money. Think about how fast you can build wealth if your completely out of debt?

These steps work very well, as I used them years ago to get out of debt and create wealth.

Since doing so I have traveled all over the world and never once had to finance any of my travels, almost everything I buy in life now is in cash.

Everything I do now is set by goals and a plan. Debt is crushing, get rid of it!

Ultimate Cash Stuffing Guide: How To Simplify Budgeting The Easy Way

How To Build Wealth Beyond Your 50’s

The main point of this article was to show you how to scale your financials in your 50’s or at any age. You may be above 50 and wondering, what about me?

I’m older, and at an even later part of my life right now. Maybe you’re in your 60s and 70s thinking, “I already built financial status in my 50s, but I want more!”

Everything you’ve read through this article, applies to you regardless of your age.

Again, what you’ve just learned is the fundamentals of building wealth at any age regardless of experience or previous knowledge.

These wealth building fundamentals have existed for years and have allowed countless numbers of people to become millionaires in both net worth and total financial assets.

One of the best ways to grow your wealth is to create a side business or side hustle, and create more income. In the case that you don’t have one already, you can sign up to our free course newsletter and we will show you how.

We have been marketing online for years and are experts at it, we will show you how to create additional income streams that can help you build even more wealth.

Here is a video that I did that walks through the importance of several of things we covered in this article today.

Building Wealth In Your 50s For Retirement

I hope this article gave you some insights and new ways you can start applying everything you learned on how to improve any financial situation at any age. Here’s a quick review of what you should do to create the best financial situation for yourself…

- Create a wealth management growth plan

- Set up proper retirement savings accounts

- Prepare on financial paper for your retirement

- Create good financially sound spending habits

- Reduce your expenses on credit cards and get out of debt

- Save more and increase your income

- Spend less, the best practice to follow

- Invest in the right & best financial assets

- Recession proof your retirement

The knowledge and guidance throughout has been gathered from decades of experience we’ve learned from helping others scale their financials.

We’ve coached and consulted for people far older than 50 and many far younger than 50.

This is why regardless of your age, you CAN learn how to build your wealth and net worth.

You just need to learn the right wealth building methods and apply them.

The methods and insights we have shared with you are proven methods on how to build wealth in your 50’s and have been used by tens of thousands of people successfully.

We really hope this article has been extremely helpful to you. If you have any questions, don’t hesitate to post them in the comments section below or just say hello.

Sincerely,

Your Friends And Partners

Richard And John Weberg