How To Get Out Of Debt Fast In 8 Steps

No matter how large your debt is, or how crushing it feels, it’s really not as complicated as it may seem to become debt free.

You can actually get out of debt a lot quicker than you think..

I am talking from personal experience, as many years ago, when I was in my late twenties, I had a little over $60,000 in unsecured debt alone, meaning it was mostly from credit cards and other bills that did not have an asset attached to it.

And once I put my mind to it, and came up with a solid plan, in 8 months I was completely debt free..

The plan I came up with, and the steps I used will work for anyone, no matter how large your debt is, as these steps have worked for tens of thousands of people, they are proven and they work.

Getting out of debt is an investment in you and your future, you can not build wealth or create financial security if your drowning in debt.

It Takes Desire And Commitment To Get Out Of Debt

Getting out of debt is not going to happen by itself, your going to need a big desire to actually do it, because it will take lots of discipline and focus..

The more discipline and focus you have, the faster you will get out of debt…

Now, before you get started with the actual steps, first you will need to become accountable and committed to making changes.

As YOU are they key to making any get out of debt plan work!

- You will need to make a REAL decision to get rid of your debt once and for all, and stick to it. No waffling, if you are not stead fast in your decision you will never get out of debt.

- Use self talk to keep you committed. Talk to your self daily, so you have a laser focus that you are going to get rid of your debt. Making a commitment to change will be the hardest part.

- If you have a spouse or significant other, you will need to get them on the same page to make sure your commitment matches. You both need to follow the get out of debt plan in order for it to work.

- You will need to look at how you spend your money in a totally new light, if you do not, you will most likely spend your entire life deep in debt, because you will always go back to your bad habits and go right back in debt.

- If your unwilling to make some short term sacrifices, do not even bother, you will be in debt the rest of your life. You have to be willing to say, no I do not need that.

- Quit caring what your friends and family think “Stop keeping up with the Jones’s” they do not pay your bills.

- Do not buy a new car, just because your neighbor or brother did, many people do this and it is just plain STUPID!

Spending more than what you make sells your income at a cost to you, to the future, as you pay interest on debt.

If you ever want to become debt free, or even better yet, build real wealth, you need to learn how to make your money work for you, and PAY YOU DIVIDENDS in the future, and not the other way around….

Steps For Getting Out Of Debt Fast

Here is the plan I used, and the steps I took to get completely out of debt in 8 months.

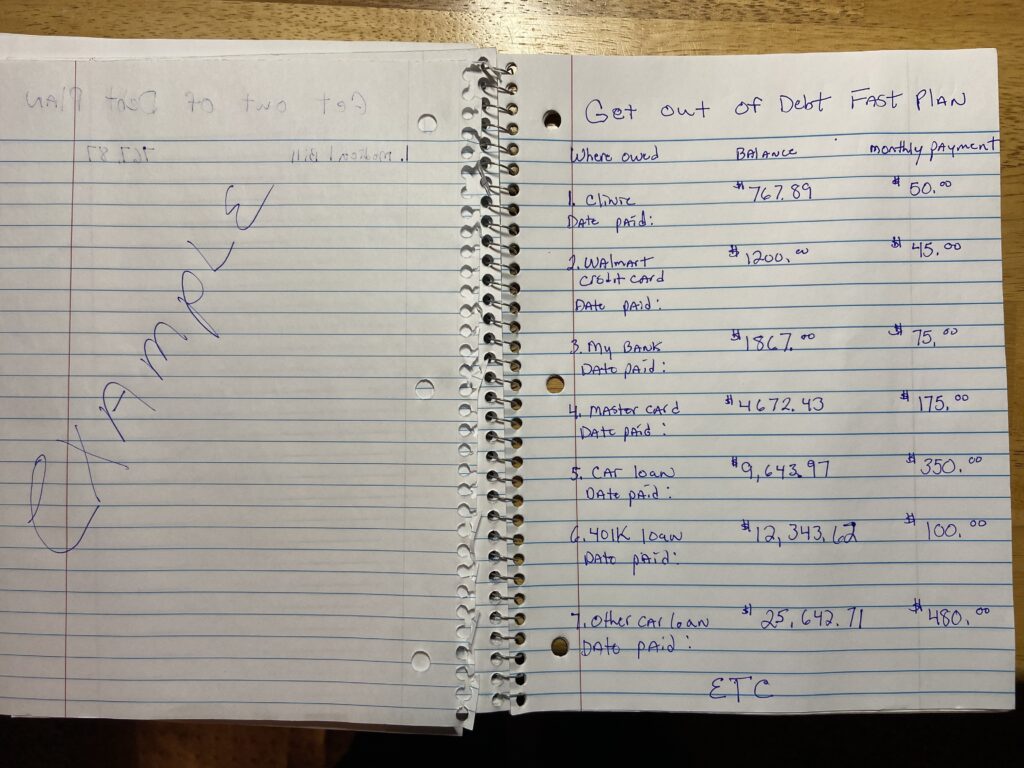

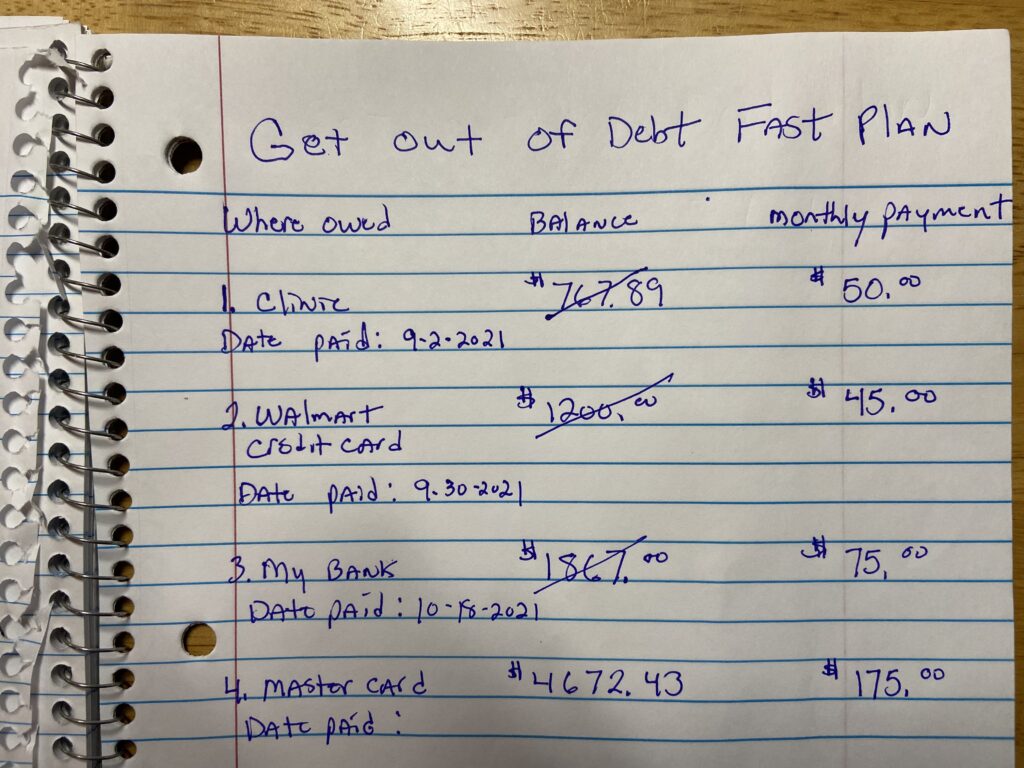

Step 1. Write Down All Of Your Debt Balances And Monthly Payments

You need to know where you are starting from, and you need to see how bad it really is.

The key point here – is to grab a notebook dedicated for your get out of debt plan, and literally write it all down.

Do not use your computer, phone or tablet, grab a notebook and a pen, and write it all down.

There is something very magical that happens in this process, by writing everything out.

List Your Debts From Least Amount Owed To Highest

Write down in a notebook the amounts you owe on every loan, credit card, mortgage, car payment, medical bills, and etc.

Also write down the minimum payment for each debt, and it’s due date. Leave spaces between your entries for you to be able to write some future notes.

Step 2. Cut All Frivolous Spending

Do not buy anything you do not absolutely need. Some people spend so frivolously they could actually build wealth by just investing the money they spend on needless stuff.

According to CNBC the average American has $90,460.00 of debt. That’s a whole lot of stress.

Data also Shows: The average American retiree now carries $70,000 In Debt. 70% of seniors aged 65 and above are currently holding various forms of debt.

In my opinion, if you have that kind of debt, the only time you should see the inside of a restaurant is if you’re working there…

16 Ways to Quit Mindless Shopping and Spending

The biggest problem for most people is they have no clue how much they are really spending everyday, they do not add up every miscellaneous purchase they make.

Here is a real life example – Several years ago, I gave counsel to a couple that are good friends of mine. I once worked with the husband and he was always coming to work asking to borrow money from co-workers, people started getting pretty pissed by this, so I asked him what was going on.

He confided in me that they were always coming up short and going deeper in debt.

Now, I knew how much money he made, as I was his boss, so I was surprised as to their situation, as many people where we worked made a pretty decent living, and where we live the cost of living is very low.

I offered to help them by looking at their financial situation and find where they were going wrong.

One night they came over to my house and brought over a list of all their debts and monthly payments.

After looking at this list, I kept thinking okay, there must be something missing, as it looked like they had over $1600.00 leftover after paying all of their bills and monthly expenses.

I asked them a few more questions, and pulled out some additional information about the rest of their spending habits.

Come to find out, they were both buying several 20 oz bottles of pop a day, between the two of them it averaged 6 bottles a day.

At the time, a bottle of pop was 1.89. So 6 bottles times 1.89 = $11.34 a day, times 30 days in a month = $340.20

Okay, I was starting to find out the whole picture of their spending habits, but wait there was more..

I then asked them how often they really ate out, and the wife admitted that they actually ate out for almost every meal.

So between fast food, and dining in restaurants, we came up with an expense daily for them and their two kids of $60.00 a day on average. $60.00 a day times 30 days = $1800.00 a month.

Now, if you take $1800.00 plus $340.20 that equals a whopping $2140.20 a month they were spending just on pop and eating out…

The fact is, more than half of Americans actually spend MORE than they earn each month, according to a Pew Research study, and use credit to bridge the gap.

Pretty easy to see how every month they were going deeper in debt and coming up short..

My friends were actually stunned, they never dreamed they were spending this much money.

As most people do, they way underestimated their actual spending habits, this is why people end up in so much debt.

I am sure you can see by just this one example, how a couple like my friends, could easily make some changes and get out of debt extremely fast.

Unfortunately, for this couple they failed to make the changes, and years later are still always struggling and borrowing money to make ends meet.

They will be most likely drowning in debt forever.

How To Simplify Budgeting The Easy Way

There is a saying “Eat like a pauper for a little while, so you can eat like a king the rest of your life”

Cut Out All Non-Essential Expenses

Create a household budget (give every dollar a job), and stick to it, do not buy things you do not need.

A) Stop buying anything at gas stations except gas.

B) Meal plan, do not eat out, eat left overs for lunch. Do not go out to eat, you can not afford to. Just because your co-workers or friends do it, does not mean you have to.

C) Use coupons when shopping for food, buy when there are sales. Make inexpensive meals that last, beans, rice, potatoes, and ground beef make great hot dishes.

D) If you drink pop, stop it, drink water, tea or coffee instead, they are less expensive and way better for you anyways.

E) Stop buying clothes, you have more than what you know what to do with.

F) Stop buying lottery tickets, your not going to win.

G) Reduce your TV bill. Cable and satellite TV programming is expensive. You can get a Roku player for like $30 and get tons of free movies and programming through the apps on it.

Better yet, sell all of your TVS and cut out watching TV all together until you are out of debt, this is what I did.

You will find that later on when you get TV again, your not as interested in it, and you will have become more active and probably have lost weight.

It’s incredible how quickly these spending habits accumulate. Each dollar put towards paying off debt speeds up the process of becoming debt-free.

Step 3. Clear The Clutter And Sell Everything You Don’t Need

Everyone has stuff lying around their home or garage that they no longer use, or have saved just in-case they might use it some day.

So clear the clutter, and sell your extra stuff that you can live with out and use the funds to start paying down your debts.

Have A Garage Or Yard Sale

If you live in a neighborhood that permits it, a good old-fashioned garage or yard sale is normally one of the fastest and easiest ways to sell your unwanted belongings.

FaceBook Buy And Sell Pages

Otherwise, in today’s digital age, pretty much every town has its own buy and sell pages on Facebook. My sister in law sells all her unwanted stuff this way, and says she gets more money for it sometimes than she spent on it.

Every little bit of money will help pay down your debt, and gets the process started.

Plus clearing some clutter out of ones life, can be a strong reinforcement of a new you. It can also give you a feeling of accomplishment towards your debt reduction goals.

Every dollar you can put towards paying off your debt, is all the much faster you will become debt free.

How To Save Money If Your Paycheck Is Stretched Thin

Step 4. Create More Income

Every bit of income you can muster up, will help, even if it is only $100 to a few hundred dollars extra a month.

Think about it, if one of your smallest balances owed is around a $1000 as an example, with the steps I have given you thus far, you could easily pay off this debt your first month.

Paying off your debt fast is about building momentum, which I will explain more in the next step.

There are numerous ways to create extra cash, think outside of the box.

How Do You Create More Income?

Ask For A Raise – Maybe you have not had a raise in a long time, so it might be time to get up the courage and go ask. Anything is better than nothing.

Work Over-Time – Remember it is only temporary, so if it is available at your job, put in a few extra hours every week.

Second Job – if your current employer does not offer over-time, you could get a part-time job or side hustle for an extra 10 – 20 hours a week.

Sell Your Skills – Do you have any technical, or writing skills? We now live in the digital age, and there are plenty of sites online like Fiverr, that will allow you to sell your skills for profit.

Rent Out Your Extra Space – Do you have extra space in your house or garage? You can rent it out for extra money. People are always looking for storage spaces. Where I live there is a big shortage of rental storage places, and you have to find alternatives or get on a waiting list.

Affiliate Marketing – There are thousands of businesses online that are eager to pay people to promote their products and services.

Network Marketing – We have been doing network marketing for years and we have made a very considerable amount of money doing it. There is unlimited earning potential with the right MLM companies.

We can even show you how through our free marketing course..We make our living doing affiliate marketing and network marketing.

Every step I share with you in this get out of debt plan, I did as well to get my family out of hock. I even worked three jobs, one was full-time, and the other two were part-time.

I deeply desired to get out of debt fast, and that is why it only took me about 8 months to get us completely debt free.

Step 5. Pay Off Your Debt Starting With Smallest Balance First

Remember I said it is all about creating momentum, well, that is why you start with the smallest balance first.

It’s time to begin repaying your debts one by one and trigger a ‘snowball effect’.

This strategy involves paying off the smaller balances first, which yields some quick victories that can have a positive psychological impact. Meanwhile, you can save the larger loans for last when you have more funds available to pay them off.

Ultimately, the goal is to channel all your extra funds toward your larger debts until they are eliminated, leaving you completely debt-free.

Initially, it might feel like you’re pushing a snowball uphill, as it grows larger and more challenging to manage. However, once you reach the top, a gentle nudge will cause it to roll effortlessly all the way to the bottom.

The hardest part is in the beginning and sticking to the plan.

How To Create Momentum To Pay Off Your Debt Fast

You start with your smallest balances owed, what ever that is, you should have them already wrote down in a notebook, listed in order from smallest balance to largest.

Take all of the extra income you have uncovered from the previous steps we have gone through, and start to pay off the smallest balance first, and only pay the minimums on all of the rest of your balances.

In your notebook cross off each debt as you pay them off, and write down the date that you did in the space you left for notes.

This will reinforce in your brain what you are working to accomplish and will aide you in not giving up on reaching your ultimate goal of being debt free.

As you pay off each debt in full, you’ll have more funds to allocate toward the next one, potentially allowing you to pay off multiple smaller debts simultaneously.

This approach is the quickest way to become debt-free. It generates momentum and a sense of excitement as you make tangible progress toward your goal.

Starting with the largest balance is not recommended as it can impede your progress.

With a longer loan term, larger debts often require smaller minimum monthly payments in comparison to the amount of debt owed, which means it will take longer to see significant progress and free up less money quickly.

Instead, focus on paying off smaller debt balances first to build momentum and achieve faster results.

Step 6. Negotiate With Your Creditors

In case you are in a dire financial situation and struggling to pay off multiple debts that you have fallen behind on, it’s worth reaching out to your creditors to negotiate a lump sum payment for a lesser amount.

Creditors are often willing to negotiate a lump sum payment, particularly if it’s been a while since you made any payments. Even if the debt has been sold to a collection agency, they are usually open to negotiations for a lower lump sum payment.

When you reach a creditor on your list that you haven’t paid anything to, it’s time to initiate negotiations.

Creditors may agree to accept 40% to 60% of the debt you owe, and sometimes even as much as 80%, depending on the type of creditor.

Explain your situation and offer to pay them a specific percentage of the balance you owe. They may respond with a counter offer. Once you agree on an amount, make sure to get written confirmation that the debt is considered paid off.

Keep in mind that not all creditors may be open to negotiations. Don’t be discouraged if some of them refuse.

Keep working towards your goal of becoming debt-free. This is a viable option only for those who are struggling to keep up with their payments and have fallen significantly behind.

Step 7. Create A Budget And Stick To It

As you start to get a handle on paying off your debt, you need to create a budget and stick to it.

If it is not in your budget, then you must not buy it, otherwise you will just go back into debt.

My wife has a very unique way of budgeting, it is actually very smart. (I budget my money a little differently, but same principles)

What she does is very simple, she creates categories for her budget and keeps track of them in a notebook.

Then every time she gets paid, she writes herself checks and sticks them in an envelope for each fund category. She decided a head of time how much each fund gets, and she never deviates from the amount.

She then subtracts the amount from her checking account, leaving money for necessities and everyday bills, like utilities and such.

As an example she has a..

- Investment Fund

- Furniture Fund

- Heating & Cooling Fund

- Clothing Fund

- Rainy Day Or Emergency Fund

- Gifts Fund

- Car Fund

- ETC…

When she wants to spend any money on stuff other than necessities, her fund must have the amount of money in it needed, otherwise she does not spend the money.

This way, she is always paying cash for anything she wants to buy, and always has an abundance of money available to her.

We also keep our money separate, I budget my money and she budgets her money based on what we have decided each of us is responsible for. (She does not come to me, and I do not go to her for money)

This way, neither one of us can be irresponsible enough to destroy our entire budget or finances.

You might be surprised how fast you can build big fat bank accounts doing it this way!

And the reason I put creating a budget so far down in the steps, is because until you learn some money management skills and how to get out of debt, you have no money for any real budget, you just need to start getting out of debt first, and quit spending money foolishly!

If you keep your old spending habits, it does not matter if you create a budget, your never going to get out of debt. Your spending habits are the key to money mastery and becoming debt free!

Step 8. Start Building Wealth

I have learned over the years through my many challenges and financial mistakes that I never wanted to be a slave to money ever again.

I wanted to take money out of the equation, meaning take care of your financials and money will always be there when you need it.

It does not have to consume you, nor should it.

Learn to stay out of debt and put your money in the right places, and you will have more money than you know what to do with.

You need to look at money in a different light, same with how and why you purchase anything.

If I only knew at 18, what I know and understand now at 52, I could have been very wealthy by the time I was 35, very easily…

But if you are anything like me, I had no one to show me the way, and I learned the financial lessons the hard way.

Just realize no matter what age you are now, you can start a whole new path, you’re never too young or too old to create financial prosperity.

Read Also: How To Build Wealth In Your 50’s – The Ultimate Money Guide

And: Strategies For Building Wealth In Your 20’s Fast

Imagine being able to take all the money you were using to pay off your debt, to now building your wealth, think how fast it could happen, it does not have to take decades…

Don’t Repeat Your Past Mistakes

Once you have achieved the feat of becoming debt-free through your hard work, it’s crucial not to repeat the same mistakes that led you there.

Avoid digging another hole for yourself by practicing the responsible financial habits I have outlined in this article.

In Conclusion

Depending on how large your debt is, and how determined you are to follow these steps completely, will be big factors in how long it takes you to get out of debt completely, you may not be able to do it in 8 months like I did.

Regardless, if it takes you a while longer, it will always be worth it.

I learned many valuable money lessons through my own experience of becoming debt free, and so will you.

When money no longer dictates to you how you live your life, that is when you will truly be debt free…

We really hope this article has been extremely helpful to you. If you have any questions, don’t hesitate to post them in the comments section below or just say hello.

Sincerely,

Your Friends And Partners

Richard And John Weberg