What Is IRA Gold? Retire In Style With An Individual Retirement Account

IRA Gold is a type of self-directed individual retirement account (IRA) that lets you invest in and fund your account with gold bars and coins.

Investing in a gold IRA is a smart way to diversify your savings portfolio from stock market volatility. When you invest in gold, you’re investing in a physical asset that has has been highly valued for thousands of years.

To learn more of the details about what is IRA gold? Keep reading or grab your 100% free IRA Gold kit from one of the two providers listed below, they are the top precious metals companies in the industry, and can also guide you through the entire process..

| Goldco – Get Your Free Gold IRA Kit Here |

| Augusta Precious Metals – Get Your Free Gold IRA Kit Here |

What Does IRA Gold Mean?

The acronym IRA stands for “Individual Retirement Account.” A traditional IRA is a tax-deferred account that allows people to save for retirement.

And with a traditional IRA or Roth IRA you can invest in individual stocks, mutual Funds, exchange-traded funds, bonds, reits and cash – certificates of deposit.

With an IRA Gold account you purchase and invest in physical gold that qualifies under IRS Gold IRA tax rules.

What Type Of Gold Qualifies?

Gold coins and bars. IRA Gold must meet highest quality and fineness levels. The purity grade needs to be 0.995 or higher to qualify for a gold IRA.

Are IRA Gold Contributions Tax-Deductible?

Yes. The same IRS tax rules and benefits that apply to other IRAs also apply to gold IRAs.

It’s important to note that the rules for deducting IRA contributions and making Roth IRA contributions can be a little complex, so it’s always a good idea to consult with a tax professional or refer to IRS guidelines for more information.

Contribution Limits

For 2023, the total contributions you can make each year to your Gold IRA are the same as whats allowed with traditional IRAs and Roth IRAs, and can’t be more than:

- $6,500 ($7,500 if you’re age 50 or older), or

- If less, your taxable compensation for the year

However, you may have additional contribution room from previous years.

For past years of 2022, 2021, 2020 and 2019, the total contributions you make each year can’t be more than:

- $6,000 ($7,000 if you’re age 50 or older), or

- If less, your taxable compensation for the year

The IRA contribution limit does not apply to:

- Rollover contributions

- Qualified reservist repayments

Join The Free Gold & Silver Web Conference!

“Attend the latest online web conference to get information you need to diversify your retirement into Gold Or Silver.”

Can You Roll-Over Your Current Retirement Account Into A Gold IRA?

Yes, you can roll over funds from your traditional IRA, Roth IRA, 401(k) or 403(b) to a gold IRA.

This is one of the common ways to fund Gold Individual Retirement Accounts. It can also be funded through cash.

Is It hard To Set Up An IRA Gold Account?

No, there are precious metal companies that specialize in helping people through the entire process.

The process is very straightforward and they will facilitate it with you from start to finish, and provide ongoing support.

The fastest and best way to learn more and get started is to grab your free Gold IRA kit by clicking on the image below.

What Are the Benefits of Investing In Gold?

There are several potential benefits to investing in gold, including:

Gold is a timeless asset: It has NEVER been worthless, gold has held value for thousands of years and will continue to be valuable for thousands of years to come.

Diversification: Gold can be a good way to diversify your investment portfolio, as its price tends to move independently of other assets like stocks and bonds. This can help protect against losses in other parts of your portfolio and potentially improve overall returns.

Hedge against inflation: Gold is often considered a hedge against inflation, as its price tends to rise when the cost of living goes up. This is because gold is a physical asset that retains value over time, while the purchasing power of paper money can decline due to inflation.

Safe haven asset: Gold is often seen as a “safe haven” asset, meaning that it may be a good choice to hold during times of economic or political uncertainty. This is because gold is a tangible asset that is not subject to the same risks as paper assets, like stocks and bonds.

Liquidity: Gold is relatively easy to buy and sell, making it a liquid asset. This can be important in the event that you need to sell your gold quickly in order to meet financial obligations or take advantage of investment opportunities.

Tax advantages: Gold IRAs offer the same tax advantages as traditional IRAs, such as tax-deferred growth and potential tax-deductible contributions.

It’s worth noting that gold is not without risks, and its value can fluctuate over time. As with any investment, it’s important to carefully consider your financial goals and risk tolerance before deciding whether to invest in gold.

Gold IRA Tax Advantages

When investing in a Gold IRA and planning for retirement it is always nice to know there are some tax advantages you can benefit from.

Saver’s Tax Credit

The IRS says you might be able to take a tax credit for making eligible contributions to your Gold IRA. It’s known as the Retirement Savings Contributions Credit, or saver’s credit. You can learn more here to see the IRS qualifications.

Relief From Inheritance Taxes

Following the death of the asset holder, some Self-Directed IRAs allow assets to be passed along to beneficiaries with few or no tax implications. Side-stepping certain inheritance taxes could be a very nice relief for the person you designate as a beneficiary for your Gold IRA.

Tax-Deductible Contributions

And just like other traditional IRA’s, a gold IRA qualifies for the same tax deductions based on your contributions.

Lower Capital Gains Tax

And on a last note, Capital gains tax rates are lower than income tax rates, so you can keep more of your money when your ready to sell your Gold from your IRA when you retire.

And because it is a long term investment, more than a year, you pay a lower capital gains tax rate.

What Are The Downfalls Of Investing In Gold?

Of course, there are also some downfalls to investing in gold.

The biggest downside is that at times gold can be volatile. The price of gold goes up and down, but so do all investments. So it is important to have a good strategy in place for your investment portfolio.

Also, gold doesn’t generate dividend income as some stocks and other investments do. So if you’re looking for a passive investment income, gold may not be the best option for you.

And finally, gold can be a physical asset that has to be stored, and there can be fees associated with it.

So while there are many advantages to investing in gold, there are also these downfalls that you need to be aware of.

How Does A Gold IRA Make You Money?

One of the main ways to make money from growing your holdings in a gold IRA, is to sell these assets for a profit when you retire.

As over time, gold has historically grown greatly in value, now that is not guaranteed, but that is the main way to make a profit from your investment.

The other thing to realize as well, is a gold IRA is a retirement savings vehicle for your retirement, and good way to diversify your investment portfolio with a tangible asset that has NEVER been worthless.

When investing in stocks as an example, companies can go bankrupt and out of business, and these stocks then can become absolutely worthless, and you lose out completely and never recover your investment.

Another way you benefit, is by tax deductions based on your contributions, you reduce your tax debt every year by your contributions to your gold IRA.

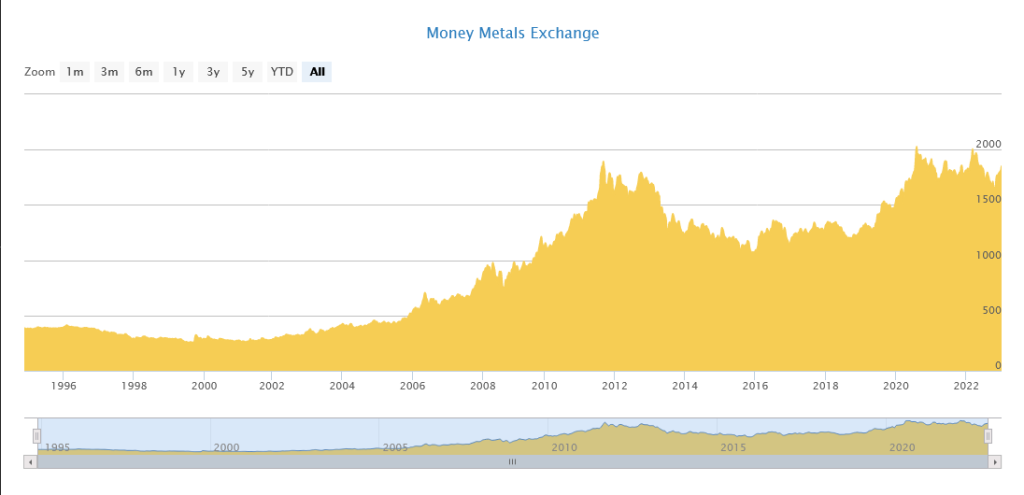

Historical Gold Prices From 1995 To 2023

Gold prices in 1995 where under $500 per ounce, and have grown to where they are today of over $1500.00 per ounce, and gold has been over $2000 an ounce at times.

You can check today’s price by clicking on the image below and it will take you to the Money Metals website where you can check any current precious metals prices.

How Do You Open A Gold IRA?

To open a gold IRA, you’ll need to follow these steps:

- Choose a custodian: A custodian is a financial institution that holds and administers your IRA assets. There are many custodians to choose from, so you’ll want to research and compare options to find one that meets your needs.

- Set up the account: Once you’ve chosen a custodian, you’ll need to set up your account by completing the necessary paperwork and providing any required information. This typically includes identifying yourself and your beneficiaries, choosing the type of IRA you want to open (such as a traditional IRA or a Roth IRA), and deciding on the investments you want to hold in the account.

- Fund the account: To fund your gold IRA, you’ll need to make a contribution or rollover assets from another retirement account. The amount you can contribute to your IRA will depend on your age and income, as well as the rules for the specific type of IRA you have.

- Invest in gold and other precious metals: Once your account is set up and funded, you’ll need to decide how to invest the assets in your IRA. This typically involves purchasing gold and other precious metals through a brokerage firm or other investment provider. You’ll need to choose the specific types of metals you want to invest in and the amount you want to invest.

Now this may sound complicated, but it does not have to be, when you use highly reputable gold IRA facilitator such as Goldco. Watch this very short 1 minute video to see how easy it can be.

Final Thoughts: What Is IRA Gold?

If you’re looking for a way to ensure your golden years are comfortable, an IRA gold account may be the perfect solution.

With this type of retirement account, you can hold physical gold coins and bars in addition to other investments.

We really hope this article has been extremely helpful to you, and you have learned what is IRA Gold and how these retirement savings accounts work.

If you have any questions, don’t hesitate to post them in the comments section below or just say hello.

Sincerely,

Your Friends And Partners

Richard And John Weberg

FAQs

What are the benefits of having a gold IRA?

The three main benefits of a gold IRA, are tax benefits, long-term asset growth, and diversifying your investment portfolio with a valuable tangible asset, that has never been worthless.

Investing in a gold IRA allows you to reap the benefits of a traditional IRA while also enjoying the added benefits that gold has to offer. Gold is a valuable asset that has historically outperformed the stock market, making it a wise choice for those looking to protect and grow their retirement savings.

What are the risks of investing in a gold IRA?

The biggest risk of investing in a gold IRA is that the price of gold could drop sharply just like any investment, and you would suffer losses. However, this risk is mitigated by the fact that historically gold has grown in value, and in times of high inflation gold has been relatively stable or has had high growth. You should always consult with a qualified tax advisor.

Is my gold insured while in private storage?

Yes. Your gold is insured against covered losses by the depository storage facility while stored there. In addition to the substantial physical security depositories provide, they typically use a London underwriter.

Can I store my IRA gold at home?

No, According to IRS rules, these assets must be held in a qualified storage facility, known as a depository. Otherwise they do not qualify under any tax benefits as an IRA.

The other purpose of this rule is to ensure the safety and security of the assets in the IRA. A depository is a professional storage facility that is specifically designed to hold precious metals and other valuable assets.

It typically has high-security measures in place, such as 24-hour surveillance, alarms, and restricted access, to protect the assets it holds, and is insured.

If you want to invest in gold or other precious metals through an IRA, you’ll need to choose a custodian that offers storage options at a depository. The custodian will handle the process of purchasing and storing the assets on your behalf.