Gold Roth IRA: The Smart Way to Invest

In recent years, the Roth IRA has become one of the most popular retirement account options for American investors. And for good reason – Roth IRAs offer some benefits, including tax-free withdrawals and the ability to have your money grow tax-deferred.

But what if there was a way to make your Roth IRA even better? A way to boost your returns and insulate your portfolio from market volatility?

Enter the gold Roth IRA!

In this blog post, we’ll take a look at what a gold Roth IRA is, how it works, and why it just might be the smartest way for you to invest for retirement.

What is a Gold Roth IRA?

A gold Roth IRA is a type of retirement account that allows you to invest in physical gold bullion as well as other precious metals.

While most traditional IRAs only allow you to invest in stocks, bonds, and mutual funds, a gold Roth IRA gives you the flexibility to diversify your portfolio with hard assets like gold and silver.

How Does a Gold Roth IRA Work?

A gold Roth IRA works just like a traditional Roth IRA—with a few key exceptions. First, you’ll need to choose a custodian who specializes in precious metals IRAs (more on that later).

Second, you’ll need to decide what percentage of your assets you want to allocate to gold and other precious metals. And third, you’ll need to decide which type of gold you want to buy.

When the time comes to purchase your gold, you have two options: you can buy it yourself or have the custodian buy it on your behalf. If you go the DIY route, you’ll need to take care of home gold storage and insurance yourself.

But if you have the custodian buy it on your behalf, they’ll take care of all that for you.

Benefits of Investing in Gold

There are several reasons why investing in gold makes sense—especially if you’re looking for a safe haven during times of economic uncertainty.

Here are just a few of the many benefits that come with investing in gold:

Gold is timeless

It doesn’t matter if we’re in a recession or experiencing an economic boom—gold always holds its value. It tends to increase in value during times of economic turmoil as investors flock to the safety of precious metals.

Gold is portable

One of the best things about investing in gold is that it’s easy to transport. Whether you’re moving across town or the country, you can easily take your gold with you. This makes it an ideal investment for people who are constantly on the go.

Gold is liquid

Another great thing about investing in gold is that it’s highly liquid—meaning it can be easily converted into cash when needed. So whether you’re facing unexpected expenses or just want to cash out on your investment, selling your gold is quick and easy.

Gold is affordable

Contrary to what some people think, investing in gold doesn’t have to be expensive. In fact, there are many ways to invest in gold that are both cost-effective and efficient.

One popular option is buying gold coins from online dealers like Money Metals Exchange. No matter which route you choose, investing in gold is an affordable way to add diversity and safety to your portfolio.

Investing in a Gold Roth IRA

If all this talk about investing in gold has got you thinking about opening up a Roth IRA, we’ve got good news: You can do both at the same time!

That’s right—with a little help from a custodian specializing in precious metals IRAs, you can roll over your existing retirement account into a brand new gold Roth IRA.

And best of all? Your investment will still qualify for all the same benefits as a traditional Roth IRA.

So what are you waiting for?

Get ready to learn more about how investing in gold can help secure your financial future!

GRAB YOUR FREE WEALTH PROTECTION KIT TODAY!

Protect & secure your retirement savings while you can!

Gold Roth IRA Benefits & Drawbacks

Now that we’ve answered the question, “What is a gold Roth IRA?” it’s time to take a closer look at the benefits and drawbacks of investing in gold through a retirement account

Benefits

- Gold is a timeless asset that always holds its value

- Gold is portable and easy to transport

- Gold is liquid and can be easily converted to cash

- Gold is affordable and there are many ways to invest in it cost-effectively

Drawbacks

- The process of opening a gold Roth IRA can be somewhat complicated and time-consuming

- You’ll need to find a custodian who specializes in precious metals IRAs

- You’ll need to pay taxes on any gains you make when you sell your gold

So there you have it: a complete overview of gold Roth IRAs. Now it’s time to get started on your own investment journey!

Gold Roth IRA Guidelines

Like any investment, there are certain guidelines you’ll need to follow when investing in gold through a Roth IRA. These guidelines exist to protect both you and your investment, so it’s important to be aware of them before you get started

Here are the three most important things to keep in mind.

- You can only invest in gold that meets certain purity standards

- Your gold must be stored with an approved third-party depository

- You can only purchase gold coins from authorized dealers

By following these simple guidelines, you can ensure that your investment is both safe and compliant.

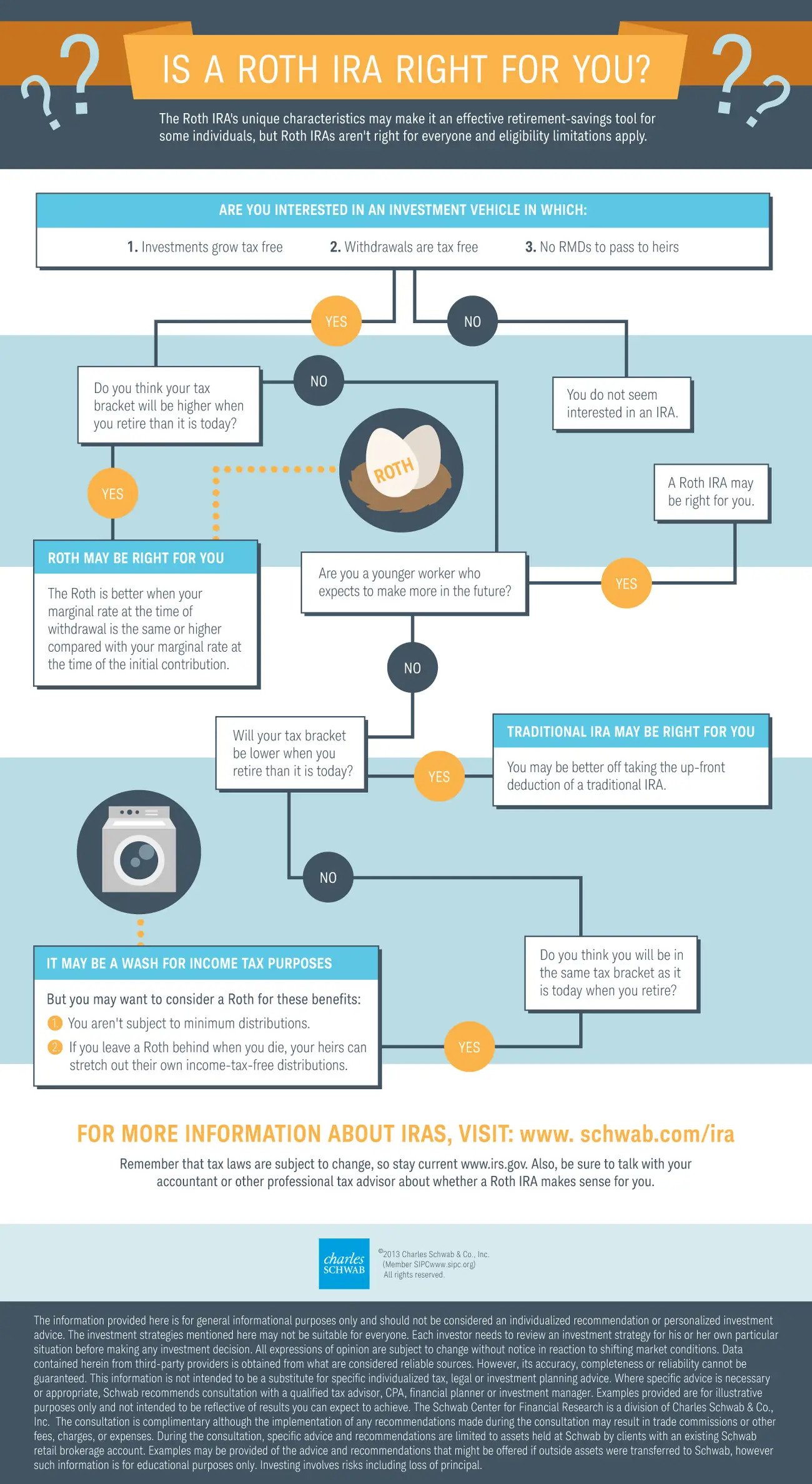

Roth Gold IRA vs. Other Account Types

There is no simple answer when it comes to Roth Gold IRA vs traditional IRA vs SEP IRA. The best way to decide which option is right for you is to consult with a financial advisor.

However, here are some general pros and cons of each account type:

Roth IRA

- Suitability: Anyone

- Tax Status: Pre-tax

- Contribution Limits: $6000 (under 49), $7000 (50 and over)

- Deductible: Yes

- Benefits: You can lower your taxable income now

- Requirements: Must be making less than $66000 (Single) or $105,000 (Married/Joint) to deduct total contributions

A Traditional IRA

- Suitability: Anyone

- Tax Status: Post-tax

- Contribution Limits: $6000 (under 49), $7000 (50 and over)

- Deductible: No

- Benefits: Withdrawals are NOT taxed in retirement

- Requirements: Must be making less than $125,000 (Single) or $198,000 (Married/Joint) to deduct total contributions

SEP IRA

- Suitability: Self-employed or small business owners

- Tax Status: Pre-tax

- Contribution Limits: $58,000 or 25% of your annual compensation – whichever is smaller.

- Deductible: Yes

- Benefits: Higher contribution limits

- Requirements: Must be self-employed or work for a self-employed person. Employees must work for the business for at least three of the last five years.

As you can see, each account type has its own unique set of benefits and drawbacks. The best way to decide which one is right for you is to speak with a financial advisor.

Get Your FREE Gold IRA Kit!

“Start your investement the RIGHT way”

Final Thoughts: Why A Roth Gold IRA is a Smart Investment

A Roth gold IRA is a smart investment for several reasons. First, it provides all the benefits of a traditional Roth IRA with the added security of investing in gold

Second, it’s a great way to diversify your portfolio and protect your wealth from inflation. And finally, it’s a flexible investment that can be used for a variety of purposes, including retirement planning, wealth building, and more.

If you’re looking for a safe, secure, and affordable way to invest in gold, a Roth gold IRA is the perfect solution.

Thanks for reading!