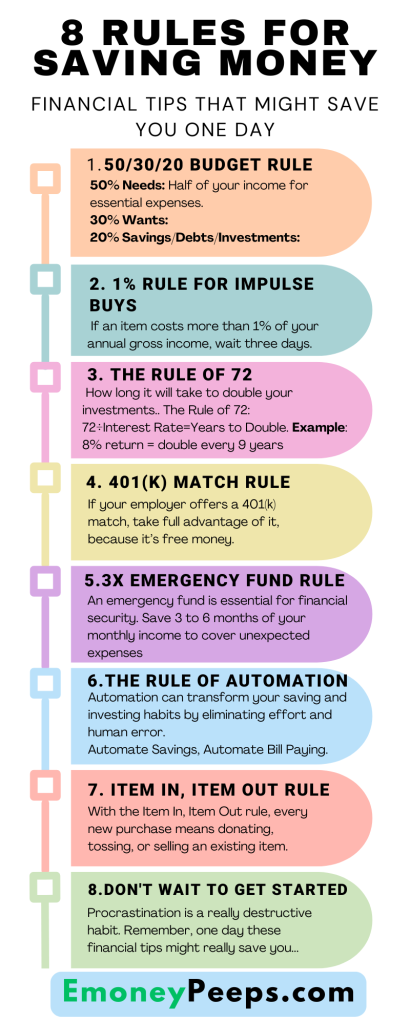

8 Rules for Saving Money: Financial Tips That Might Save You One Day

Saving money effectively is a critical skill that can help you achieve financial freedom, weather unexpected storms, and create long-term wealth.

Whether you’re just starting your financial journey or looking for ways to improve, these 8 essential financial tips and rules for saving money can help guide you toward smarter money management.

1. 50/30/20 Budget Rule

The 50/30/20 rule is a simple yet effective way to allocate your income to cover essentials, enjoy life, and save for the future.

Here’s how it works:

- 50% Needs: Use half of your income for essential expenses like food, housing, insurance, transportation, and basic utilities.

- 30% Wants: Allocate 30% to things that enhance your quality of life, such as travel, entertainment, or fashion.

- 20% Savings: Dedicate the final 20% to savings, including emergency funds, debt payments, retirement accounts, or investments.

By following this rule, you ensure that your spending is balanced, sustainable, and goal-oriented.

2. 1% Rule for Impulse Buys

Before making a big purchase, consider this golden rule: if an item costs more than 1% of your annual gross income, wait three days. Why does this work?

- It prevents emotional or impulsive buying decisions.

- Often, you’ll realize you don’t truly need or want the item.

This small delay encourages thoughtful spending and protects your budget from unnecessary expenses.

How to Stop Impulse Buying – 16 Ways to Quit Mindless Shopping and Spending

3. The Rule of 72

Want to know how long it will take to double your investments? Use the Rule of 72, a simple formula:

72÷Interest Rate=Years to Double

For example, with an 8% annual return, your money doubles in just 9 years. This rule helps you stay motivated about saving and provides a clear path to long-term financial growth.

20 Smart Financial Habits To Build Wealth At Any Age

4. 401(k) Match Rule

If your employer offers a 401(k) match, take full advantage of it. Many companies will match a percentage of your contributions, essentially providing free money for your retirement savings.

Here’s how to maximize this benefit:

- Contribute at least up to the maximum match percentage offered.

- Regularly review your 401(k) allocations to align with your financial goals.

5. 3X Emergency Fund Rule

Building an emergency fund is essential for financial security. Aim to save 3 to 6 months of your monthly income to cover unexpected expenses like medical bills, car repairs, or job loss.

An emergency fund acts as your financial safety net, helping you avoid debt when life throws you a curve-ball.

6. The Rule of Automation

Automation can transform your saving and investing habits by eliminating effort and human error. Setting up automatic transfers ensures you save before you spend.

Here are some practical steps:

- Automate Savings: Set up a direct deposit into a savings account or investment account.

- Automate Payments: Schedule recurring payments for bills to avoid late fees.

In life, automation empowers individuals to take control of their finances by eliminating manual tasks and procrastination, ensuring consistency in saving money, bill paying, and investing.

Making it all effortless, and on autopilot.

I have personally used automation in building my investments for years, I have set up automatic purchases of stock in what are known as DRIPS (Dividend Reinvestment Plans).

Money gets taken out of my checking account every single month, without me having to lift a finger.

7. Item In, Item Out Rule

Clutter can hinder both your mental and financial health. With the Item In, Item Out rule, every new purchase means donating, tossing, or selling an existing item.

This minimalist approach ensures:

- A balanced living space.

- More thoughtful buying decisions.

- A focus on quality over quantity.

8. Don’t Wait To Get Started

Procrastination is a really destructive habit. The longer you wait to get started, the less impact these rules will have on your life.

You can not buy back time!

And many times when we put stuff off in life, years can pass before remember “oh Yea, I should have done that, I remember reading this 10 years ago, and now I’m screwed!”

Remember, one day these financial tips and rules for saving money might really save you…

Why These Rules Matter

Each of these rules contributes to a bigger picture of financial wellness. Whether it’s through budgeting, leveraging employer benefits, or building a robust emergency fund, these strategies help you take control of your finances and achieve your goals.

Here is another budgeting system many people use: Ultimate Cash Stuffing Guide: How To Simplify Budgeting The Easy Way.

Final Thoughts

By incorporating these 8 rules into your financial routine, you can simplify your money management and set yourself up for long-term success.

Share these tips with friends and family, and watch how small changes lead to big results.

We really hope this article on 8 Rules for Saving Money: Financial Tips That Might Save You One Day has been extremely helpful to you.

If you have any questions, don’t hesitate to post them in the comments section below or just say hello.

Sincerely,

Your Friends And Partners

Richard And John Weberg

Copyright Notice: If this content is reproduced in full on any other website other than EmoneyPeeps.com, it is without our permission, and is copyright infringement. We own all rights to this article. Any attempts to infringe the website content will result in strict legal actions. You are free to link to any article on our website, but not copy our content.